georgia property tax relief

To be eligible for the stimulus checks for seniors residents must be already receiving New Yorks Enhanced STAR School Tax Relief exemption from school property taxes for the 2022-2023. Specializes in reducing property taxes for Atlanta area property owners- representing our clients at the Board of Equalization and working with proven results.

Legislative Momentum In 2022 New And Expanded Child Tax Credits And Eitcs Itep

Glynn County collects on average 061 of a propertys.

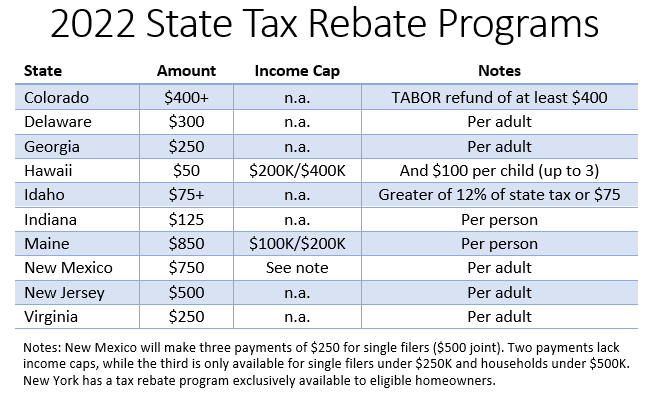

. 250 for single filers 375 for heads of household with dependents 500 for joint filers The governor also said he would like to allocate about 1 billion to give property owners a. For more information on tax exemptions visit dorgeorgiagov. Specializes in reducing property taxes for Atlanta area property owners- representing our clients at the Board of Equalization and working with proven results.

A Benefits Enrollment Center BEC can offer you personal one-on-one assistance as you navigate program eligibility and look to apply. But the Lincoln Institute of Land Policy found. Georgia Property Tax Relief Inc Duluth Georgia.

About the Company Georgia Property Tax Levy Relief CuraDebt is a company that provides debt relief from Hollywood Florida. Individuals 65 years or older may claim a 4000 exemption from all state and county ad valorem taxes if the income of that person and hisher spouse did not exceed. The median property tax in Glynn County Georgia is 1108 per year for a home worth the median value of 180900.

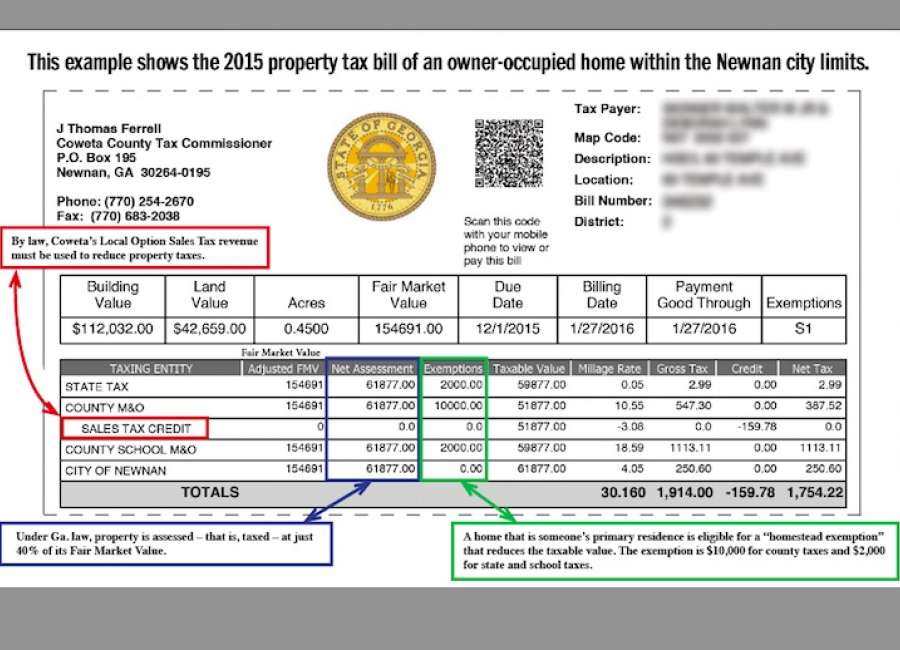

It was established in 2000 and is a member of the American. Most Metro Atlanta Counties have appeal deadlines approaching. Property tax in Georgia Properties in Georgia are assessed at 40 of fair market value.

The amount is 93356 during FY 2022 per 38 USC. Georgia Property Tax Relief Inc. CuraDebt is a company that provides debt relief from Hollywood Florida.

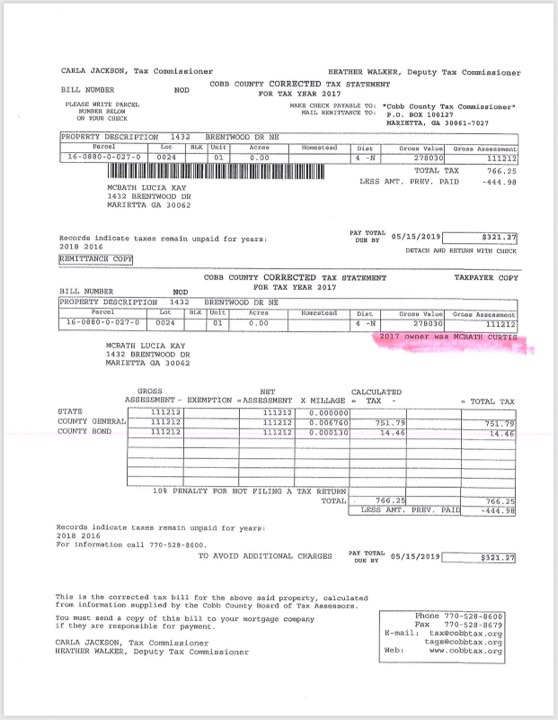

The actual tax amount that is levied on the property is based upon three factors. People who are 65 or older can get a 4000 exemption. 1 the assessed value of the property 2 the tax rate or millage rate and 3 the individual property ownerâs.

It was established in 2000 and has been an active part of the. Basically it gives the state legislature the option to provide for a property tax break - they just havent done it since 2008. The value of the property in excess of this exemption remains taxable.

As such a contribution made by July 15 2020 may be deducted on an individuals 2019 Georgia income tax return subject to the normal dollar etc. Any Georgia resident can be granted a 2000 exemption from county and school taxes. It would provide for about a 500 savings to homeowners.

Georgia Property Tax Relief Inc. About the Company Georgia Property Tax Relief. For example a home with a fair market value of 100000 would be assessed at 40000 minus.

California has been at this for 30 years without success. Specializes in reducing property taxes for Atlanta area property owners- representing our clients at the Board of Equalization and working with proven results. With support from the National Council on Aging NCOA.

In 1978 Californians adopted Proposition 13 in the name of property tax relief. Individuals 65 Years of Age and Older. Call today to reserve your right to appeal.

Georgia Property Tax Relief Inc.

Learn More About Georgia Property Tax H R Block

Tax Rebates You Can Get Up To 500 In Tax Refunds Under The New Plan In Georgia Marca

Top Property Tax Protest Companies In Georgia Real Estate Bees Ga Property Tax Reduction Appeal Consultants Services Near Me

Tax Exemptions For Senior Homeowners In Georgia Red Hot Atlanta Homes Active Adult Experts

Petition Jackson County Georgia Senior Exemption For Eliminating School Taxes Change Org

Perry Courage S Push For Property Tax Relief A No Go For Now

Brookhaven Seeks Property Tax Savings For Homeowners Reporter Newspapers Atlanta Intown

Barrow County Georgia Tax Rates

Fulton County Property Owners Will Receive 2022 Notices Of Assessment

What Is Homestead Exemption How To Reduce Property Taxes Georgia Taxes 2021 Property Taxes Youtube

The Georgia Homestead Exemption Decoded Brian M Douglas

Property Tax Rates To Be Set In Next Few Weeks The Newnan Times Herald

Veteran Tax Exemptions By State

Legislation To Provide Senior Homestead Tax Exemption In Bartow Receives Final Passage In Georgia Senate Allongeorgia

3 Years Of Homestead Exemptions Revoked For Ga Congresswoman Back Taxes Assessed Allongeorgia

Tax Credits Georgia Department Of Economic Development

Property Tax Break Passes Georgia Legislature For Atlanta

Georgia Homestead Exemption Decoded Dan Mckenzie Options Mortgage Services Alpharetta